Think Twice About Gold

How to Ride an Investment Trend

Gold was an awesome investment back in 1999 when everyone was talking about selling gold.

Back then gold was seen as a stupid investment, it had plummeted in price for many many years.

There were incredible arguments why it should be sold. Governments around the world were selling off their gold.

They certainly were not expecting the price to go up.

Now Gold is touted as a great investment, AFTER it has increased in price for over 10 years.

Could it go higher? Definitely.

But a top could also be equally close.

Let’s not forget how the majority thought real estate was a great long term investment in 2005.

Where the crowds have a strong consensus on a ‘great’ investment, so much so the waitress can tell you its a no brainer, the likelihood a switch in direction is brewing becomes greater.

There are many good reasons to own gold, including in physical form. Just remember there were also incredibly logical fundamental arguments to buy real estate in 2005, and buy internet stocks in 1999. The arguments in the opposite direction were dismissed.

Who knows if Gold will truly soar to even greater heights, it may still have a long way to go, or it may not. Only the future will tell.

What we can be sure of is when it reaches it’s pinnacle top, more people will be spouting gold as the investment to be in.

It will be a frenzy, just like real estate was in 2005, and just like internet stocks were in 1999.

Keep a level head and don’t get caught up in the “wisdom” of crowds.

Those who profit the most through changes in society and finance are true independent thinkers.

And remember, you don’t have to expose yourself to investment risk to invest in a booming trend.

In the real estate boom some people made millions online selling leads to real estate companies, and that money went straight into the bank. Arguably a much safer way to profit from a financial trend.

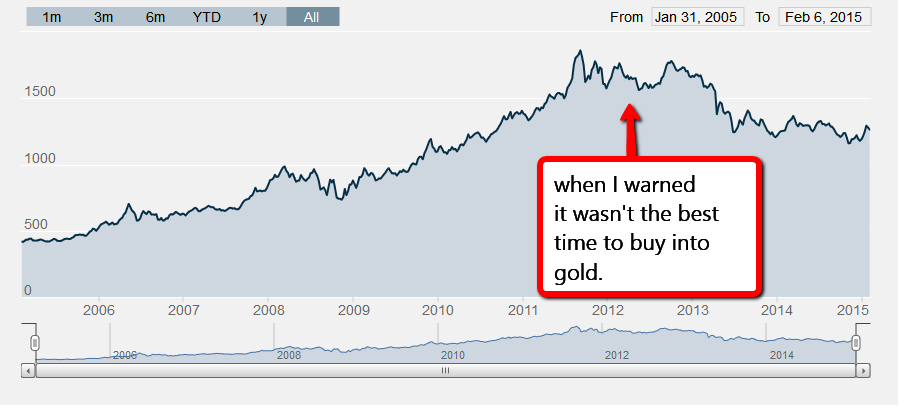

UPDATE (Feb 2015 – 2.5 years later):

Gold did indeed drop of its high. It was a clear warning to me with sentiment towards gold so high. Gold probably has a bit further to drop before it starts a trend tthat would take it towards a new high, which could take many many years to play out.

47 Comments

Your right about following the crowds. Just don’t do it. If the 45 trillion in private US debt ever deleverages (and it will) deflation will be the order of the day and it will really suck to own gold that you bought at $1,700 an ounce.

Gold is way undervalued. Real estate was overvalued and still is. People are still selling their gold for pennies on the dollar at pawn shops. People are still taking out loans to invest in real estate. We are far from a bubble in gold. If you look at just the inflation rate and the value of the dollar you would see gold should be over $10,000. Real estate on the other hand should be down another 30-40%.

It is great to be a free thinker but we still need to backup what we think with data.

The last sentence in the first paragraph is a blanket statement. Real estate is stratified, meaning that there are price divisions (100,000-200,000, 200,000-500,000, 500,000-780,000; these are simply examples, and not absolutes).

In one division the prices may be going up, while another is going down.

People who got caught in the real estate bubble were definitely following the crowd, and their own high hopes. Many agents took advantage of this, and banks hired people unqualified to sign off on the underwriting of loans. This way, they ducked prosecution by the fact that this was not illegal. Unethical, yes! Other agents warned their clients, most often to no avail. The American Dream, like a carrot on a stick.

Yes, it was a blanket statement. I do realize in some place the bubble was not as big as other places. So that would make my statement incorrect. There are also small pockets that are recovering right now.

In the majority of places I have looked it is still true. I live in the middle of the country not on the coast where most things where way overvalued. To find places that were not hugely overvalued you need to go to the middle of nowhere where the houses were not selling during the bubble. The rest of the places are still overvalued. They may not be 30-40 percent overvalued but time will tell.

I personally started with gold in the 800’s , just purchased another few bars for my son at 1540 and feel there is still A TON of room left in fact it hasn’t even started to go up yet. The only reason it is where it is, is because of paper gold and its not working any longer just look at whats happening to JPM :). Gold is real money. With all the central banks in the world just printing money like its going out of style gold and silver are the only safe store of wealth left. Also Greece is looking into a silver based coin and an exit from the Euro.. The price hasn’t even started to move. Shorting JPM now thats another good bet.

While there might be some parallels, gold is not real estate. I think we’ve still got some time before gold hits it’s high. Some very smart (wealthy) people, some I know personally, don’t think the economy is out of the woods yet, and believe there’s a good chance it will still hit a new low.

The majority of smart wealthy people were caught out by the Real Estate crash, and the Dot Com crash. Think independently.

And a struggling economy does not have to mean inflation. Deflation was the problem in the U.S. in 2009 during the great recession.

Right you are, and a great majority of these investors are now walking away from loans that are far more than their property is now worth.

Hey Chris, when it comes to all these bubbles I always follow this one rule that I have followed for many, many years.

“””Buy when nobody wants it and sell when everyone wants!”””

This one motto has served me very, very well in the past. Real Estate, gold, silver, stocks etc.

I started buying silver and gold coins back when gold was $235 per/ounce and silver was like $4 per/ounce. I have made a very good profit over the years. As a matter of fact, I still own quite a hoard of coins. I’ve been selling off some holdings but stopped a while back when JP Morgan stepped in an sold a bunch of gold contracts (Around 15000 contracts I think) to make the price drop back down to around $1500 because they’re trying to help the present administration in office right now. (Whole different story.)

Anyway, for anyone buying into the hype…you may get blown away! It’s like any other thing right now. The game is rigged and if you don’t believe it, your gonna’ lose your shirt.

But, with the way the economy is right now, it’s still prudent to buy what you can afford to lose and that’s it. Once all this fiat money burns, game over. Precious metals win! Just watch your timing.

Thanks for bringing this up Chris.

Rene’ G.

My thoughts are that now is not the best time to invest in gold, I do like gold as a long term investment similar to my real estate holdings. However if you are looking to invest and simply watch your money grow before your eyes…probably not wise. Go against the common wisdom as Chris stated, now is actually a much better time to be buying houses than 2005-2008. Best advice I can give is to make you money somewhere else but keep it by owning property.

Why are you assuming the masses are investing in Gold?

Dispite all the ad you see, hear and read only a tiny percentage

of investment money is in gold or even gold backed paper i.e.

gold funds or mining stocks.

The world physical pool of gold is tiny in relation to the

total fiat paper money flooding the world. If only 10% of

this fiat paper was invested in gold the price would skyrocket.

But you are right to advise people to avoid investing in gold.

With the silver/gold ratio at 57/1, historic ratio is 16/1, silver is a

much better investment.

Its not as simple as the real estate bubble, or the dot com bubble; this time it is a world wide economic crisis perpetrated by banksters and governments by using fiat currencies and inflating the crap out of them by printing trillions of dollars into existence from nothing. It is a massive debt crisis the likes of which has never been seen in all of human history. The reason gold and silver will continue to go up is because there are only a few historically reliable places to put the ‘value’ you have earned over a lifetime. It is a hedge against inflation. Inflation goes higher and higher the more money they print. Higher prices do NOT mean goods and services cost more, it means your money is worth less. The time to sell gold and silver will be when everyone is panicing to buy, not just some chatter about buying gold and silver.

When the U.S government printed record money in 2009, it was during deflation.

See my other comment on how money printing is only part of the inflation picture.

Yes, there was deflation; but not because of printing money. It was a reaction to the massive mortage crash and the lowering of the price of oil. The gov also uses other ways to control the inflationary pressure – like lowering interest rates; which are still very low for that reason. As well as manipulations in the markets with the help of JP Morgan and others.

That just means the inflation will be worse when the artificial controls no longer work; when the pressure gets to be too much. And that is unavoidable. Fiat currencies always die a miserable death and people suffer because of it. History shows this over and over even back to the Roman Empire (when they diluted the money supply by adding cheap metal to the gold and silver coins).

Also keep in mind that the US dollar is the world’s reserve currency. This means, among other things, that commodities like oil are purchased world wide using US dollars. Because the US dollar is used for such things world wide, their is a much larger arena within which to inflate the US dollar. The inflationary effects are much more delayed than other countries. It also means the inflationary effects are going to be felt by many more countries than just the US. Also, the inflationary effects of printing money are never felt right – it takes time to filter down into the market place.

The bottom line is that I see prices for stuff going up ALL the time!! So inflation is here NOW. It is just not yet in full force.

All the fundamentals about why hyper/higher inflation could happen have been around for a long time. But it didn’t happen. You could have made the same comment 30 years ago.

Of course all currencies end in hyper inflation, but nothing that you state indicates why it will happen soon. Its possible, but its also possible that debt de-leveraging first causes deflation, like what happened in 2009, and higher/hyper inflation comes after.

There are good arguments on either side of the fence.

This analysis ignores inflation

not incorrect technically, but wrong nonetheless.

Yes it is good to look at prices pegged to inflation too. Doesn’t in anyway change the point of the article – think independently.

Gold is going to continue to rise

If the boyz JP Morgan and HSBC were not taking it down everyday

along with the London exchange it would be much higher

With them printing trillions of dollars this is going to guarantee the rise in price

You have not seen nothing yet.

Since 2007 highly invested in gold and silver.

gold up 120% silver up 340 %

a little better than bank interest or stock market.

And the real stuff. only buy physical not the paper etf’s which might disappear like MF Global

Your results in the past do not represent the future.

The internet stock investor could have said a similar thing in 1999.

The majority of inflation happens within the commercial banking system through lending. The governments can print money, but they can’t force banks to lend and people to borrow.

The rate of inflation also has to be bigger than the rate of deflation caused by debts been written off – of which there is $50 trillion.

Yes there are incredibly strong arguments why inflation could happen – but its not the only possibility.

Ok, but what happens when the US currency crashes (inevitable)?

Yes it will happen at some point. But that does not mean it will happen in the next 1-10 years.

There are strong logical arguments to the opposite (deflation due to debt implosion), and while they are less vocal, it does not mean they hold less weight.

When high inflation happened in the 1980s, beforehand the fear was more deflation, in memory of the great depression. Again the masses were on the wrong side of the fence. I can’t predict the future and tell you which way it will go, but I advise not to get caught up in crowd hysteria, and think independently.

Go back 30 years and you will see many crazy predictions in mainstream media and among the masses…

– In 70s and 80s Oil was supposed to be gone now

– In 70s and 80s we were worried about global cooling

– In 80s the dollar was pegged to collapse

Well, I agree the gold price is something to be very concerned about. At this point, neither fundamental nor technical analysis will do one much good if we stick with trying to project trends from the last 100 or more years. We need to go back over several hundred years to observe the trans-century mega-trends that (based on a few thousand years of monetary and economic history) might be occurring right now.

(Those trends and events, if they occur, will blow the doors off any analysis that focuses only on the last 100 years or so.)

So, for example, some people feel gold (or silver) is an inflation hedge. Yet we’ve had a LOT of inflation over the last 100 years with only one major blip in gold price. So that, inflation, is not by itself, a good reason to own gold or silver.

Currently, it’s more a severe distrust of government that’s driving the price of gold. (Potential or existing inflation is merely a symptom of that.) This fundamental factor will blow the doors off the 100 plus year technical picture unless the next election turns out REALLY good for The People. But there is NO evidence an Obama or Romney election will do anything but continue the current destruction of the monetary base via Keynesian style manipulations — i.e., legalized counterfeiting of money.

So without the ultra-long shot of a Ron Paul-type election, there is next to NO chance the monetary situation in the United States is anywhere near a return to “normal” … what ever that is.

Yet, every few hundred years a sea-change does come about — a Black Swan moment — that turns everything on it’s head. Right now, the BIG Question is, is gold (or silver, or both) about to RE-monetize as the primary monetary metal, and destroy the current paper money system ?

If it does, the bull market in gold is just getting started. If the re-monetization of gold and or silver occurs over the next few years, then 5,000 to 15,000 per ounce gold is not unreasonable.

And there are NO signs we are in a “mania” yet, at all. So gold is no where near a bubble.

Therefore, if one uses this perspective, one must study the history of such things (money, banking, etc.) and decide, for themselves, if they believe it is a good probability that our money system will move away from what people like me consider to be a totally corrupt and immoral system destined for self-destruction?

Much history says the destruction of the current paper-based system is, eventually, inevitable. But it might be a slow death. As pointed out by Robert Prechter and Mish Shedlock, and several others, U. S. cash might take a long time to die. We might have significant DE-flation before IN-flation takes hold. (I use the more traditional definitions, not the modern, Keynesian ones.)

It might rally tremendously in the short to mid-term, as enough people might not perceive any other viable alternative. (A lot of people still do not understand the gold standard and how it actually works.)

But no paper system has ever lasted very long. (They say it’s max about 50 years, and we are at about 45 years.) Therefore, it seems the logical thing to do is be hedged both ways: have a strong position in physical gold and silver in your actual possession for the long term possibilities (maybe 30 per cent), and have some cash instruments for the short to mid-term (another 30 percent). The rest can be invested, but in this environment, those will not actually be investments, but speculations bordering on gambling. Unless some sanity returns to our state-driven political and economic system.

This is, basically, Harry Brown’s Permanent Portfolio, which still maintains one of THE best long term track records for capital preservation with a nice 7 to 8 percent gain per year overall for the last 30 years.

Attempting to time this market — deciding when cash will die and gold explode, or the reverse — to any precision is probably suicidal, unless you are one of the top-drawer great investors and market observers like George Soros or Jim Rogers.

Beautiful article in itself! Thanks, David.

Interestingly did “admin” aka Chris Munch not comment on this one…

Chris, adjust the price of gold with the official inflation data of the US government, and you are nowhere near the price it’s at now.

Put a stop to the paper games in gold and especially silver, and oops, it’ll skyrocket.

Without all this, have you read any of the news lately (not so much mainstream, more the independent stuff…)

1. Spain is about to crash worse than Greece, hence bye, bye Euro

2. central banks are BUYING gold… enough said there!

3. China used to be the biggest exporter of gold, but stopped doing it, and not IMPORTS gold in masses

4. Gold becomes a way to pay for gold, which marks the end of the petro-dollar

5. Bank runs on Spain & Greece, what happens when the rest of Europe runs and don’t trust banks anymore? where will they put it, in the stocks…?

6. people will run to gold when there is a war on Iran

7. where is the mania? do you see on TV “go and buy gold”? when you see that, sell it, but BUY before it’s too late…

8. Europe is discussing bonds backed by gold to reintroduce some gold standard, so people keep some confidence in the banking system that outright steals from their customers.

Do the maths and calculate how much an ounce must be worth to account for our money supply…

Dude, are you really telling people to keep their money in cash, or in stocks, which are loosing purchasing power by the minute?

Are you telling people to put it into real estate that has not yet bottomed out, even though we are let to believe that?

Who are you to advise people on that with an opinion?

Your opinion could potentially destroy people livelyhood! Your “think for yourself” is just a banner to spread your opinion under.

If people like Jim Rogers and central banks buy and the masses are not, it’s time to buy… of course 1999 would have been better, but now is still a damn good time!

What you are saying is that today’s money is more than half as much worth of what money was worth in 1980, and that’s just a ridiculous statement.

And all this to sell an Amazon book and get an affiliate commission…

Sorry, I think this is not cool at all!

As David said in his excellent and very intellectual comment, deflation could happen in the short term. That’s the point. Deflation = a lower gold price. David is clearly a free thinker making educated decisions to cover different scenarios, and doing it through real logic and historical data.

I am not saying I know which is more likely to happen in near term. Those that get caught up in the crowd mania are always very certain of the future.

In answer to your points…

1 – Countries collapsing under debt can lead to deflation or inflation – it depends on how people react. Do they print there way out (inflation) or write off debt (deflation)

2 – Central banks were selling gold in 1999 when it hit a low – so they are not good to follow on investments. See the article linked above.

3 – What were they doing when the price bottomed, or when it topped in the 80s?

4 – It ends when it ends, what happens inbetween can take many paths.

5 – Bank runs in the great depression led to deflation. Deflation causes lower prices in commodities (like gold).

6 – That may or may not happen (both the war and the run on gold).

7 – Yeah I do see ‘go buy gold ads’ starting to appear on TV. In fact it was the increase in the visibility of gold which drove me to this post.

8 – If more currency is backed by gold it limits inflation, which limits price increases in gold.

I am not saying any of your predictions are wrong, just that none of them point to a clear cut answer that gold is the best investment out there. The direction it goes in the short term depends on whether in the next ten years we saw more deflation, or more inflation. There’s good arguments on both sides.

Independent thinkers (like David) are aware of both arguments, and not emotionally attached to one argument like those who don’t think independently, so much so they resort to personal attacks on credibility to get their point across, rather than absorb a different point of view.

I would definitely agree that long term Gold is a good investment (although the best buying opportunity is behind us), but what can happen in the short term is different. Remember gold spiked in the 1980s in fear of inflation, and then crashed. Maybe people were on the wrong side caught up in the frenzy of a possible currency collapse.

Gold will soar at some point in the future in relation to paper currency, but that’s not really the point, as there’s still the short term to think of.

I don’t genuinely ponder on where to invest money because you have to have money to invest first. I could be said to be vested in gold because my husband bought me a gold necklace some twenty years ago that I practically wore off my neck. It has a damaged link, now, so I am afraid of losing it by wearing it.

My husband watches the markets and he is very interested in socio-economic trends and other things I have no understanding of.

One statement he has made to me on a few occasions, which has sunk into my brain (and helps me with what I do online too) is “when there is a lot of noise…its already on its way down.” He explained that the smart ones were already out…the followers were being sucked in.

When he said it…I thought “What?” Now I have seen many examples of it and it is something I always remember.

Just like you said here “Where the crowds have a strong consensus on a ‘great’ investment, so much so the waitress can tell you its a no brainer, the likelihood a switch in direction is brewing becomes greater.” I agree with you completely.

If gold begins to be bought on massive margins like the real estate was… then bundled and sold time again as derivatives … you might fairly compare the two at that point.

Measuring today’s gold rush and yesterdays real estate party is like A good read about the why of gold is “The Creature From Jekell Island”… by G. Edward Griffin. Unfortunately, it’s not a matter of if, it’s just when.

Personally, I’m not into gloom and doom and the end of the world hysteria & drama… however there will be some more major upheaval around the consequences of a world in debt and inflation.

Usually money is borrowed and paid back as a form of solvent business. Has anybody ever noticed a single penny of the principal of the U.S. deficit be repaid? That is what all the gold fever is about.

Ask around… every person of wealth has a significant portion of their holdings diversified in gold. Might be a telltale to know what the wealthy of the world think about gold …& silver for that matter. The reoccurring historic probability is that many many assets will be bought at fractions… by those holding the real cash & the food… at some point in the not too distant future. Hopefully, we’ll have a reset and a balancing of the budget… engineered by the creative & talented forces who are everywhere.

The problem has to demand to be solved before it will be. Might be a good idea to have a bit of gold while we are sorting things out.

And putting all your money in the bank might not be the safest place either if you choose to remember that without the printing presses… every major bank on earth would have closed a couple of years back… and what ever $ you had in there would have gone to bank heaven.

I bought some gold dec 2009 when they some said the price will go up while others said it’s on its high now. It went up. Same in 2010, 2011 and the same is going on now. The truth is: you never know. Analyst say it can go up even more, other say it is controlled by government. In the end you have to ask yourself what is gold worth to you? Suppose in the future all money disappears would you rather have 1kg of gold or a big peace of land where you can grow your own food?

The missing part of any discussion such as you raise is this:

The purchasing power of GOLD remains (as long as it’s freed from artificial subversive “fixes”)

pretty much the same decade after decade. In 1890 an ounce of Gold would buy a Colt .44 with holster and a good supply of ammo. Gold varied in the free market, but you could use twenty dollars an ounce and be close. You could also buy a Hart, Schafner and Marx 3 piece high quality suit with two pairs of pants. Today, an ounce of Gold will still be sufficient to buy those same items. But twenty bucks in paper today buys four overpriced Starbucks fancy drinks.

I have been deeply into the conspiracy against GOLD by the subversive charlatans that stole our nation’s birthright for decades. So whenever such a discussion comes up, anyone with an ounce of experience should say: “Gold price went down? Tell me this: HOW MANY OUNCES DID YOU LOSE?

The answer is NONE. So the rise and fall of the (more or less) “free” market PAPER price may vary, gold held as a last resort protection, or even to hold for the next move up, will keep you on the right course as far as purchasing power is concerned.

There’s more, but there are also spies about.

I am involved in the best (more or less) passive income program that we have ever found, so the money is coming in at last and should allow me to utilize the thousands of dollars worth of programs to “make it big” on the net. This should give me breathing space to employ the various Munchies which I have purchased. We got sidetracked after seeking out tons of images and writing our first follow up . What reason? See your own superior Winners and Losers post.

Best to you. I love your software and your attitude.

And I hated your winners and losers post. LOL We all know why. What happened to me”, said me, as I read through the excuses and thought: “Did age do this to me or what?”

That’s one post that every one has to hide their face as they read it.

Dang… I needed one more edit. Too sleepy.

Last line should read: “That’s one post from which everyone must hide their face as they read it.”

Nicely done – love the link progression from article to list to product sale. WSO sometime soon,huh?

Hey Chir,

Nice article, and your right, if the whole world is talking about buying gold, it’s probably too late… But as much as gold may be a sound investment, silver has so much more potential..

To find out why, check out crash proof 2.0

Yes I agree as there is a simple saying in the financial trading world that the trend is your friend and I would be wary that we’re reaching the top of the trend right now, so not a time to invest everything and the kitchen sink! Great post – something of an interest of mine after building trading floors for one of the largest private banks in the world, as my JOB a while back!

My thoughts exactly!

Anyone who has traded currencies/equities/commodities and knows anything about technical analysis will tell you this is definitely NOT the time to buy gold. The truth is that there is a much bigger chance you’ve already missed the boat than there is of making a killing. All this frenzy is just lining the pockets of those who were smart enough to buy 5 or 10 years ago.

But, just like every other “feeding frenzy”, you don’t hear many people talking sense about this these days …

I have read many articles about gold discovery in California and Alaska and most money was made by selling tools to mine the precious metals…

The other thought now is that how to survive in the game if you cannot print monopoly money? Hoarding food is the one important item for survival!

So with what you are saying, what is your stance? I hear your point, however what are you doing in this time of economic feasting? Do you have a plan in action, do you have a vehicle you are riding to the top, what is it that you could give to someone or better yet give to me, to right my ship?

Seems to me that the ship has sailed, as far as getting into gold. Should have done 5-10 or more years ago. In my opinion, the U.S. Dollar is dead. Just a matter of a very short period until the yuan and a few others will replace the dollar as the worlds currency. When that finally falls into place, we, here in the states, are truly in deep, deep trouble.

Precious metals = hedge. If all this money printing continues you’ll need something that protects you from inflation.

…So I was wondering…. IF the US and/or worldwide economy Crashes–(like may have predicted)– who will be left standing to Value/Price gold or Any precious metal, Anyway??—-The local self-appointed King?? …… Doesn’t CRASH mean NO centralized monetary system would be trusted by anyone? Plus…..How would anyone ‘purchase’ goods and services??…….. by slicing off a small (designated) portion of some bullion?? Just a thought……..PS: maybe if the ‘doomsayers’ are correct one would do better with and iron plow, a small garden plot and a bunch of seeds, as opposed to a pieces of precious metals !!

Bottom line is folks we have 95 million (including immagrants) baby boomers that are no longer in their peak spending years. We also have massive debt, 45 trillion alone in private debt up from 20 trillion in 2000.

Minus the Baby boomers spending we are not going to have any real inflation and it won’t take much to deleverage that private debt. When the debt deleverages it will cause deflation in a big way and the Fed won’t be able to print their way out of it. The trigger will probably be Europe and their trillions of derivatives going bad.

Explains why Soros sold a lot of his gold recently.

1. there’s a great book on the topic of ‘crowds’ and what they can do – Extraordinary Popular Delusions and Madness of Crowds by Charles Mackay

and

2. check out a similar chart for Silver, and remember there’s a LOT less of it around, and it’s permanantly used up in a lot of manufacturing processes. 🙂

Clueless article about gold..

The DOW is propped up artificially by QE and 90% of the trades are conducted by bot algorithyms, not the market itself.

1-2% pullbacks are normal for gold. Especially for October, with a seasonal rebound around Christmas. Small pullbacks are healthy in any bull market and are expected.

ALL Fiat currencies eventually crash and we are already witnessing it globally with the current debasement. ie, Monetary easing, QE, etc.

Central banks are pouring into gold, the BRICS nations have dumped the US Dollar because its practically worthless, and is about to lose its global reserve status.

Less than 1% of Americans own precious metals and you talk about not following the crowd as if gold were in some sort of bubble.

Wanna know what’s really in a bubble right now?

– Bonds

– Debt

Ryan you hit the nail right on the head and saved me the time of educating some of these people that commented.

I have 50 ounces of gold for anyone here that can point to a time when gold has been worth zero. IMHO, if you are in paper investments, your a fool. Gold, silver and a few other choice investments are the safest way to go.

It doesn’t take a rocket scientist to understand that if you lay a silver dollar on a table in front of you along with a $1 dollar bill and compare the purchasing power of each, silver (as well as gold) is far more valuable.

How much gas would a $1 bill buy you?

Answer:Less than a third of a gallon.

how much gas would a silver dollar buy you? 9 1/2 gallons

How many gallons of milk will a $1 bill buy you?

Answer, less than a third of a gallon.

How many gallons milk would a silver dollar buy you?

Answer: 10 gallons

It’s really sad that more people don’t understand this and is one of the reasons most people struggle to just get by.

If you want to learn more about how the fiat currency works research this term:

fractional reserve banking

A visit to moneymasters.com would also serve you well.

While currency definitely devalues in the long run, in the short time span commodities like gold and silver’s relative value can climb or fall in relation to any fiat currency.

If you plan to spend your money in 100 years then Silver and Gold are a very safe bet, but over the span or weeks, months, or years you could see the value decline, even though the larger trend is up compared to currency.

Where the article states, “It will be a frenzy, just like real estate was in 2005, and just like internet stocks were in 1999”, I feel it worth arguing that this may not exactly be true. The government is not facilitating the financing of upwards of 100% of the purchase price of gold being bought, as was the case with 2005 real estate. And in the case of stocks, private financial firms financed (via MARGIN) not even 50% of the purchases of those internet stocks during their 1999 frenzy. How mainstream is the act of making leveraged bets on physical gold with borrowed money? You may think it is likely to become mainstream for the general public to make financed (via LOANS) bets on interests in physical gold? I think not. That’s not to say the market cannot be very wild, nonetheless.

“There are many good reasons to own gold, including in physical form.”

I think, for most people whom are not speculators, the physical form is the only really important way to own gold. “If you can’t hold it, you don’t own it.” Even if your gold is in a private, high security storage facility somewhere, there is NOT insurance something will not happen to them where you will not be able to access your gold.

Historically, the primary reason to own gold is as a safety measure against a government going out of control, which they can do in many ways. And ours is doing it in about as many ways as you can imagine.

The average Little Guy should own some physical gold, and probably more so silver, to protect against things going really out of whack. In such cases, it does not matter WHAT the price is. Ask the Zimbabweans whom could not, for a time during their recent great hyper-inflation, even buy bread if they did not have gold.

If gold continues to move back towards being a monetary instrument — which seems very possible, even if only in a Black Swan scenario — then the price of gold will have to approximately match the total of outstanding fiat money instruments out there. THAT is a mind-boggling number.

And I think it is always important to remember there are (at least) TWO kinds of inflation:

1.) Monetary Inflation is the expansion of the money supply. Which is in our case, is also an expansion of the debt supply. (Our current monetary expansion has not resulted in prices going up, it is theorized by some experts, because banks are keeping their funds in reserve to boost up their balance sheets, rather than loaning the money out into the economy. If that money is not circulating, then it will not drive prices up.)

2.) Price Inflation is general price levels going up. (Prices going up because of actual supply & demand would not accurately be called inflation. So if there is an area of real estate where the prices are on the low side, and people start moving into the area, and then prices start going up, that would NOT be true price *inflation.*)

Why this is important is you can have monetary inflation without price inflation … stagflation, for instance.

Right now, gold & silver are going up due more to supply & demand. They are more economically driven now. When social psychology kicks in, and people start developing the hysteria to own gold, it will become more of a bubble.

It will be interesting to see Robert Prechter’s point-of-view that social mood will drive the price of gold & silver DOWN versus the opposite idea that social mood — social negativity breeding more fear of government — would cause people to herd into gold and silver. I’m almost afraid to see that one play out.

Yet I think Robert Prechter’s insights into the differences between economic markets and financial markets is crucial. Economics tends to follow the laws of supply & demand: the higher the price, the less of it people buy. Financial markets tend to do the opposite: the higher the price, the MORE of it people buy.

He has two great charts explaining that somewhere on is website. (I think the article is *Markets Are Not Physics,* or something like that.) Financial markets, even if they start out as economic supply & demand, often end up with bubble psychology, or hysteria. If you add monetary inflation into the mix, you have a REAL problem going on.

And Alan Greenspan saying he, nor anyone, could NOT recognize a financial bubble when they were in it was either joking, lying or very uniformed.

Needless to say — but I’ll say it anyway — the current price behavior — people behavior, actually — of gold does NOT indicate that bubble psychology has anywhere near kicked in yet. That does not mean the price could not plummet. It just means it’s not in a bubble yet, either.

David

Gold always will be a great investment, but as David (the comment above) says, the best way of owning a gold is in physical form.