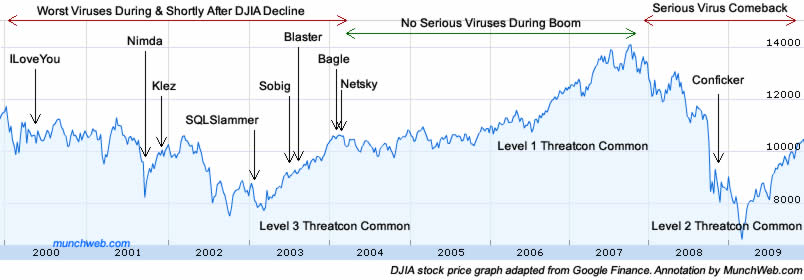

Computer Virus Increase Driven by Weak Economy?

Top Trojans & Worms Follow Stock Market Declines

I put forward some evidence to suggest that spam activity might be inversely correlated with the stock market. Is there any evidence to suggest a similar pattern for computer viruses? It appears so…

The Threatcon rating from Symantec reflects the overall global threat exposure from viruses. Viruses are very closely related to spam since the viruses are often used to send spam in the first place.

The rating goes from level 1 (low) to level 4 (extreme).

- The highest Threatcon level ever has been Level 3 which occurred multiple times in 2003 and 2004, but has not occurred since. The Dow Jones stock index bottomed in 2003 after a downward trend that lasted 3 years, so this is exactly when we would expect higher Threatcon ratings.

- The stock market peak in October was accompanied by the lowest Threatcon rating of 1, which is again what we’d expect.

PandaLabs described the most dangerous viruses of the last 20 years.

- Since 1988 the years 2003 and 2004 had 5 of the 14 most dangerous viruses as identified by PandaLabs. So those 2 years accounted for over 1/3 of the most dangerous viruses in a 20 year period.

- Some of the other viruses occurred during or shortly after stock market declines. For example, the Chernobyl virus came from Taiwan in 1998, 1 year after the Asian financial crisis.

- Since 2004 there were no serious viruses as stocks were going up to a historic high, then after stocks had turned down for the largest crash in decades, the Conficker virus hit in November 2008.

So the inverse correlation between spam and viruses against the stock market does appear to have some validity, but more robust statistical testing would be needed to help confirm this idea.

If you find any other evidence for or against this idea be sure to comment and link to sources.